It’s necessary.

Absorption rate serves as an incredibly useful reflection of market demand and property performance. Measuring the speed at which available units are taken off the market allows you to identify public market conditions, predict future trends, and adapt your strategies to stay ahead of the competition. For owners and operators in the multifamily sector, understanding and applying the concept of absorption rate is pivotal to maintaining profitability.

In this article, we’ll examine what absorption rate is, how it’s calculated, and why it matters — because leveling up your revenue intelligence calls for precise market insights.

Absorption rates help landlords and property managers gauge the strength of their rental strategy and make informed decisions. An accurate absorption rate empowers multifamily operators to fine-tune their pricing strategies. For example, a low absorption rate might indicate a need to reassess rental prices or increase marketing efforts. Conversely, a high absorption rate could suggest strong demand.

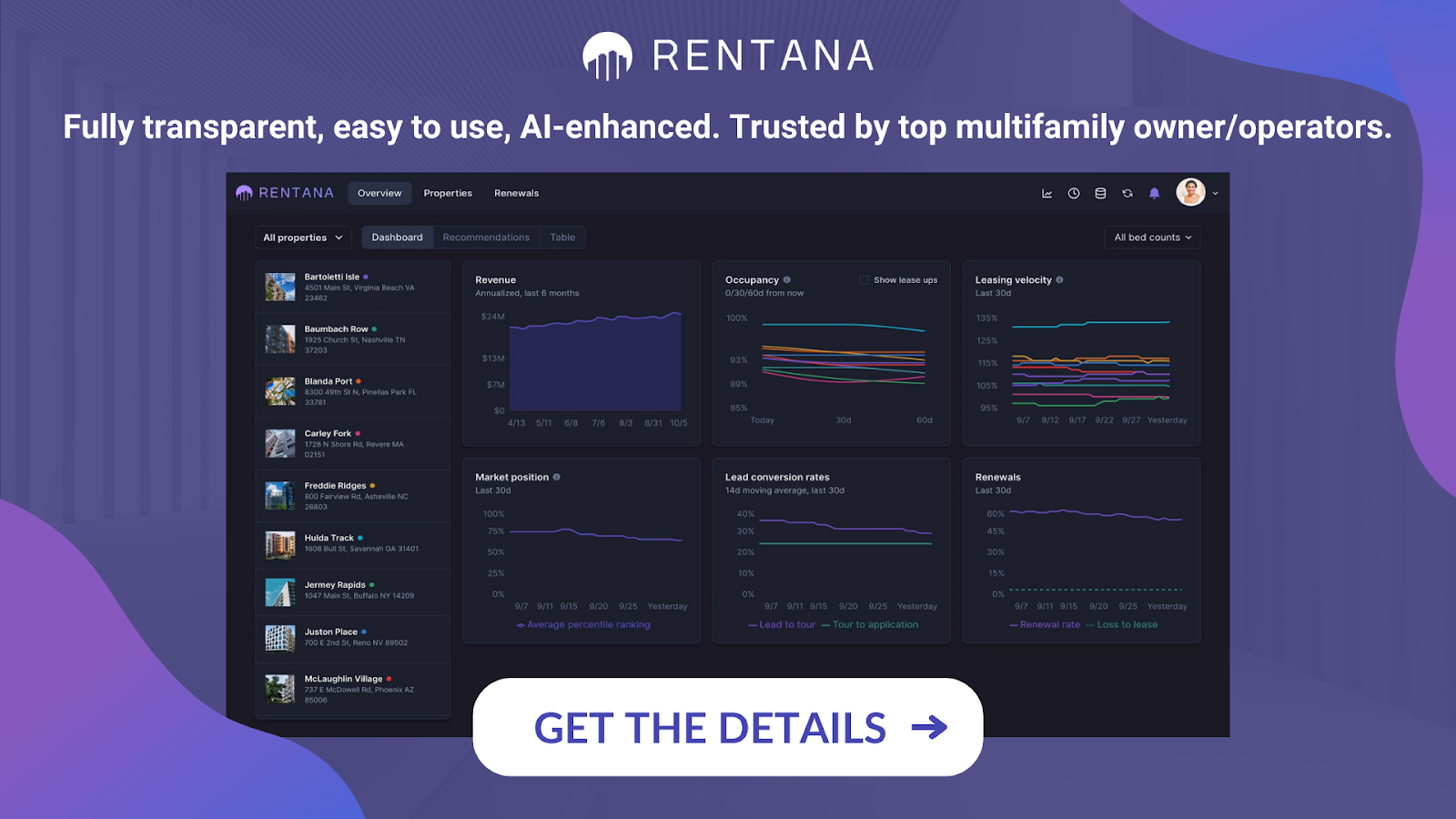

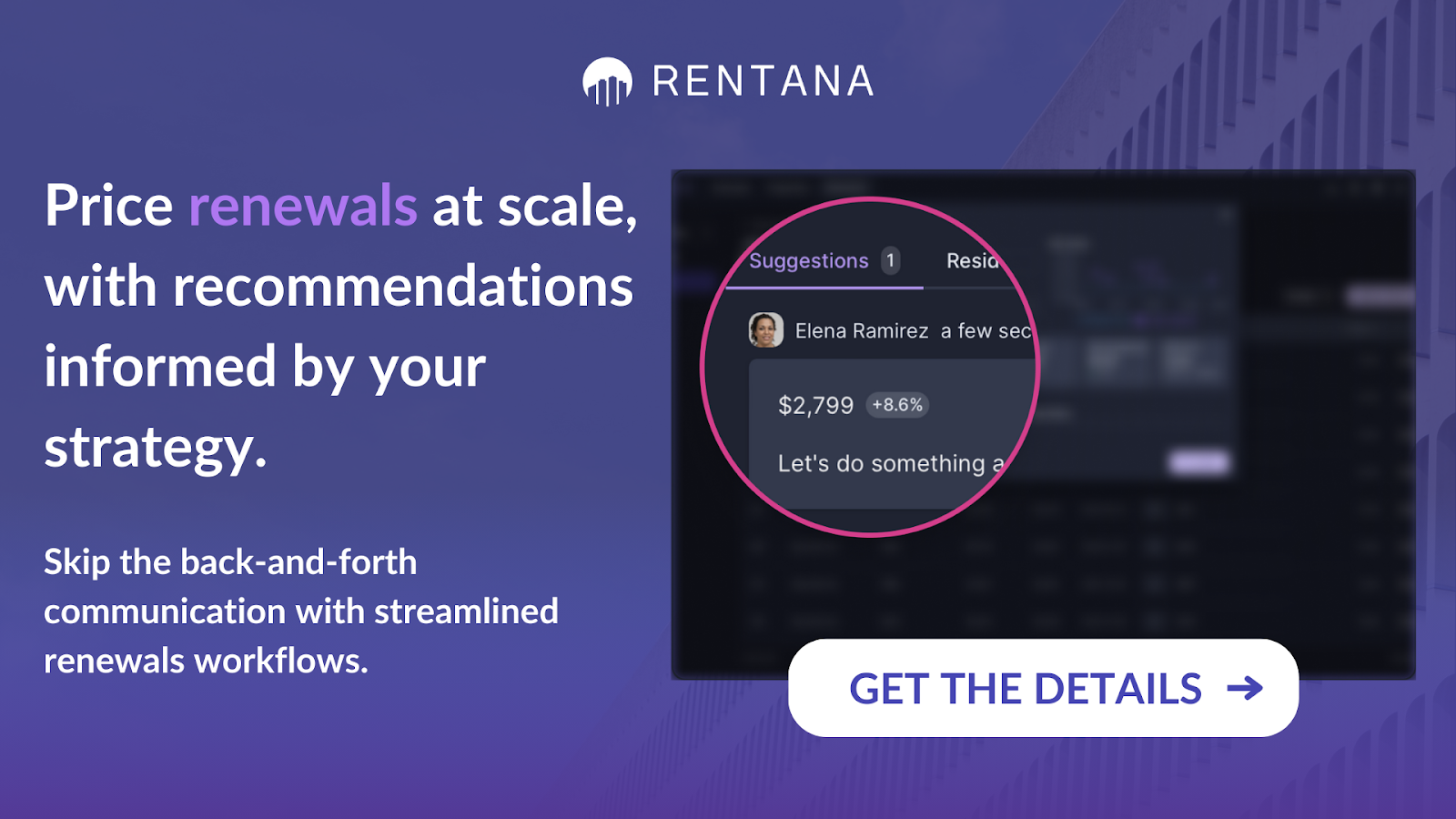

At Rentana, we know the importance of monitoring trends like absorption rates to enhance profitability. Our AI-powered platform provides real-time insights and optimized rent-pricing recommendations, ensuring you can adapt to public market shifts quickly and effectively.

Calculating the absorption rate is straightforward once you understand the formula. In real estate, this metric is expressed as the rate at which available properties within a specific market are sold (or leased) over a given period of time. To find the absorption rate, use the following equation:

Absorption Rate (%) = (Total Units Sold or Leased / Total Units Available) × 100

Here’s a step-by-step breakdown to calculate it effectively:

A high absorption rate typically indicates strong demand, with properties being rented or sold quickly. This often leads to favorable conditions for landlords and property managers since it provides an opportunity to raise rental prices or negotiate better lease terms. High demand also signals a booming market, making it an ideal time to expand portfolios or invest in new developments.

Conversely, a low absorption rate suggests a slower market where properties linger longer before being leased or sold. This scenario can signal an oversupply of units or weakened demand, prompting property owners to adjust pricing strategies or offer incentives to attract renters. For multifamily owners and operators, navigating low absorption rates requires extra attention to public market data, pricing analytics, and customer preferences.

Rentana’s AI-powered platform helps property managers stay ahead in both high and low absorption rate environments. We leverage data to precisely adjust pricing and streamline lease terms, ensuring multifamily operators can make informed decisions that align with prevailing public market conditions. When the market is strong, the tools enable efficiency to capitalize on demand. When it’s slow, Rentana provides insights to increase occupancy and revenue even under challenging conditions.

The absorption rate serves as a key indicator of whether the current real estate market favors buyers or sellers. Calculating how quickly properties are being sold in a specific area helps property owners and managers better prepare for market fluctuations and adjust strategies accordingly.

In a seller's market, where demand outpaces supply, the absorption rate is typically high. Multifamily properties tend to move quickly, often commanding premium prices. This environment can be ideal for property owners looking to take advantage of ROI, especially if they have the right pricing strategies in place. Rentana’s AI-driven platform can play a pivotal role here, allowing multifamily owners and operators to capture market momentum.

Conversely, in a buyer's market, the absorption rate tends to be lower, signifying a surplus of available properties compared to buyer demand. Property managers and owners looking to stay competitive might need to consider rent adjustments or promotional strategies to attract tenants. Using operational insights from tools like Rentana can help identify trends and make smarter, data-driven decisions without losing profitability.

The balance between the demand for rental units and the available supply significantly affects absorption rates. In markets with a high demand for rental properties and limited inventory, absorption rates tend to rise because units are leased or sold quickly. Conversely, when supply outweighs demand, the absorption rate decreases, indicating a slower turnover.

Correctly pricing units can be a game-changer. Overpriced units may take longer to lease, driving down the absorption rate. On the other hand, dynamic pricing—like that offered through tools like Rentana’s AI-powered technology — can help ensure units are leased more efficiently, positively impacting absorption rates.

The state of the economy plays a key role. High employment rates and increasing incomes generally boost absorption rates as more individuals can afford to lease properties. During economic downturns, rental demand may slow, affect affordability, and reduce the absorption rate.

The time of year can also play a significant role in absorption rates. For example, the spring and summer months often see a surge in rental activity, leading to higher absorption rates, while the colder months typically experience a slowdown.

Properties in desirable neighborhoods or growth areas with access to amenities, schools, transportation, and entertainment options usually experience higher absorption rates. Additionally, features like modern interiors, energy-efficient upgrades, and community spaces can make properties more appealing, further impacting the rate at which vacancies are filled.

In multifamily segments, the presence of new developments or aggressive marketing strategies from competing properties can influence absorption rates. A saturated market often sees a lower absorption rate as clients have more options to choose from.

Absorption rates provide valuable insight into public market demand, allowing property managers to adjust pricing strategies, plan leasing timelines, and identify growth opportunities with confidence.

At Rentana, we help you track these absorption rate data and act on them decisively. Instead of relying on guesswork, you gain clarity and control, ensuring your property remains competitive and profitable.

Monitoring your market’s absorption rate and integrating intelligent tools like Rentana will enable you to confidently position your assets for success.

Read Also:

Absorption rate in real estate refers to the pace at which available properties in a specific market are sold or rented over a defined period. It essentially measures demand, helping property operators and investors gauge how quickly inventory is being absorbed by the market.

The absorption rate is a vital metric for multifamily owners and operators because it provides a clear understanding of market conditions. Analyzing this rate lets property managers make informed decisions about pricing, marketing strategies, and operational planning to stay competitive and profitable.

The absorption rate is calculated by dividing the total number of properties sold or leased in a given time frame by the total number of available properties. For example:

If 30 units are rented in a month and 100 units are available, the absorption rate is 30%. This simple formula offers valuable insights into how fast or slow properties are moving in the market.

A high absorption rate typically signifies that demand in the market is strong, and properties are being leased or sold quickly. This could be a positive signal for property managers to consider property upgrades, higher rent pricing, or even market expansion.

A low absorption rate indicates slower market movement, meaning it may take longer to lease or sell existing inventory. Property managers in this situation might need to consider rent adjustments, additional marketing efforts, or other strategies to counteract reduced demand.

Yes, the absorption rate is a versatile metric that can be applied to both residential and commercial real estate markets. Multifamily property managers, in particular, can leverage this data to fine-tune their operations for better revenue outcomes.

The absorption rate directly influences home prices. A higher rate often leads to rising prices in a competitive market, while a lower rate may cause prices to stagnate or decrease due to lower demand.

Seasonality plays a significant role in the absorption rate. Real estate markets tend to experience fluctuations based on the time of year. For instance, spring and summer months often see higher absorption rates due to increased buyer activity, while winter months may have slower market movements, resulting in a lower absorption rate.

Interest rates play a significant role in determining the absorption rate in real estate. When interest rates are low, borrowing becomes more affordable for potential buyers and investors, often leading to increased demand for properties. This heightened demand can drive a higher absorption rate as inventory is sold or leased more quickly. Conversely, when interest rates rise, borrowing costs increase, which may reduce demand for real estate and lead to a lower absorption rate. For multifamily property managers and operators, understanding these dynamics is essential for forecasting market trends and making informed pricing decisions.